Direct Debit Adjustments

Options chosen by impacted households to resolve Council's direct debit adjustments issue

In September 2024, we let you know that we’d been using a faulty process for recalculating direct debit payments. Council took full responsibility for this error and offered our deepest apologies. We acknowledge that this faulty process caused distress for our ratepayers.

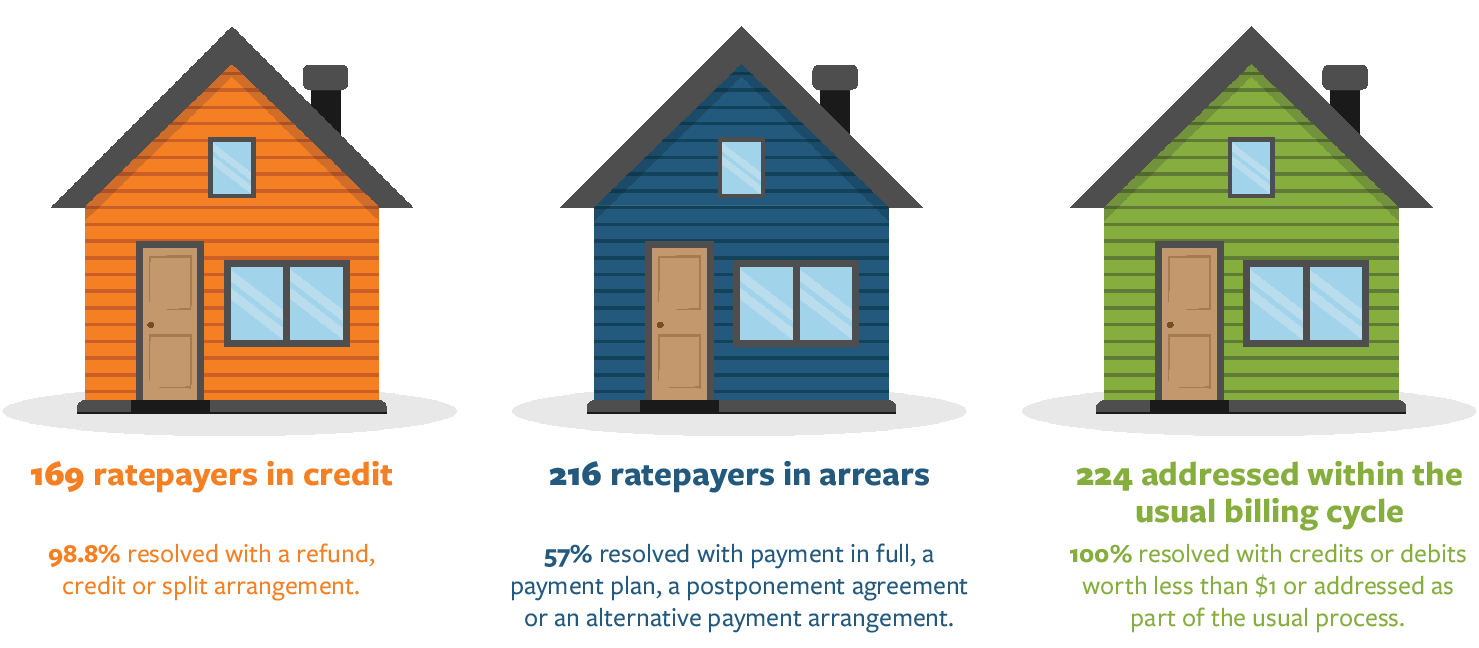

Since then we have been working with impacted households to find the best solution for their circumstances. See the infographic below to understand the options households have chosen.

While the issue was initially thought to have impacted 602 ratepayers who receive rates rebates and pay by direct debit, after further analysis of the direct debit information, it was found that more than a third of the impacted ratepayers (115 of those in credit and 109 of those in arrears) were not actually affected or had a very minor issue.

Any necessary adjustments for those ratepayers were handled within our business-as-usual processes.

Of the 385 households impacted:

- 169 had paid more rates then required

- 216 had not been charged enough and, therefore, paid less than required

How the Council worked with households to get them back in balance

Council approved several pathways to support impacted households and their families and worked with these households to find the best tailored solution for their circumstances.

Options offered

Households that had overpaid their rates due to the error could choose:

- Refund: Households receive a direct refund of the overpaid amount.

- Credit: Households receive a credit towards future rates

- Split option: Households receive a partial refund and partial credit

Repayment options for households that had underpaid their rates due to the error could choose:

- Payment in full: Households make a direct payment of the amount in arrears, either in a lump sum or instalments.

- Payment plan: Individuals set up individual payment plans tailored to the circumstances of the household

- Postponement of payment: Households defer payment of the rates arrears under Council’s Rates Postponement Policy adopted by Council on 15 November 2024 (details below)

If you are an impacted household who has chosen to postpone your rates arrears and has been sent a draft postponement agreement to sign, could you please sign and send this back to Council as soon as possible. If you have changed your mind and would like to choose a different option, please get in touch with our customer services team on (06) 374 4080 or (06) 376 0110 or email info@tararuadc.govt.nz

Rates Postponement Policy

On 15 November 2024, after community consultation, hearing of submissions and deliberations, Council adopted the Rates Postponement Policy. This is designed to ensure that those impacted have the option to pay back the debt incurred through Council error when they can better afford to do this.

In summary, the Policy says:

Any postponed rates will remain a charge on the property and will become payable on the occurrence of the following (whichever comes soonest):

- the ratepayer/s cease/s to be the owner or occupier of the Rating Unit; or

- the ratepayer/s cease/s to use the property solely as his/her residence; or

- the postponed rates are 80% of the available equity in the property; or

- the death of the ratepayer(s).

When postponement is agreed, the following provisions will apply:

- postponement will first apply in the year a completed application is received.

- the amount of rates postponed will not incur interest or penalty charges during the period of postponement.

All or part of the postponed rates may be paid at any time.

Independent investigation completed

In December 2024, an independent investigation into the direct debit error was presented to Council's Audit and Risk Committee. Council has already taken action to prevent this error occurring again in the future and are now working on further actions that will be taken based on in the investigations outcomes.

Need to contact us?

If you have any questions or need assistance, please contact our team on 06 374 4080 for the Northern District or 06 376 0110 for the Southern District or email us at info@Tararuadc.govt.nz